Manage your personal loan and credit card account right from your phone with the Avant Credit mobile app.

SOLUTIONS FOR EVERY STEP OF YOUR JOURNEY

TOOLS TO MAKE LIFE EASIER

We have the solutions to simplify your everyday financial tasks.

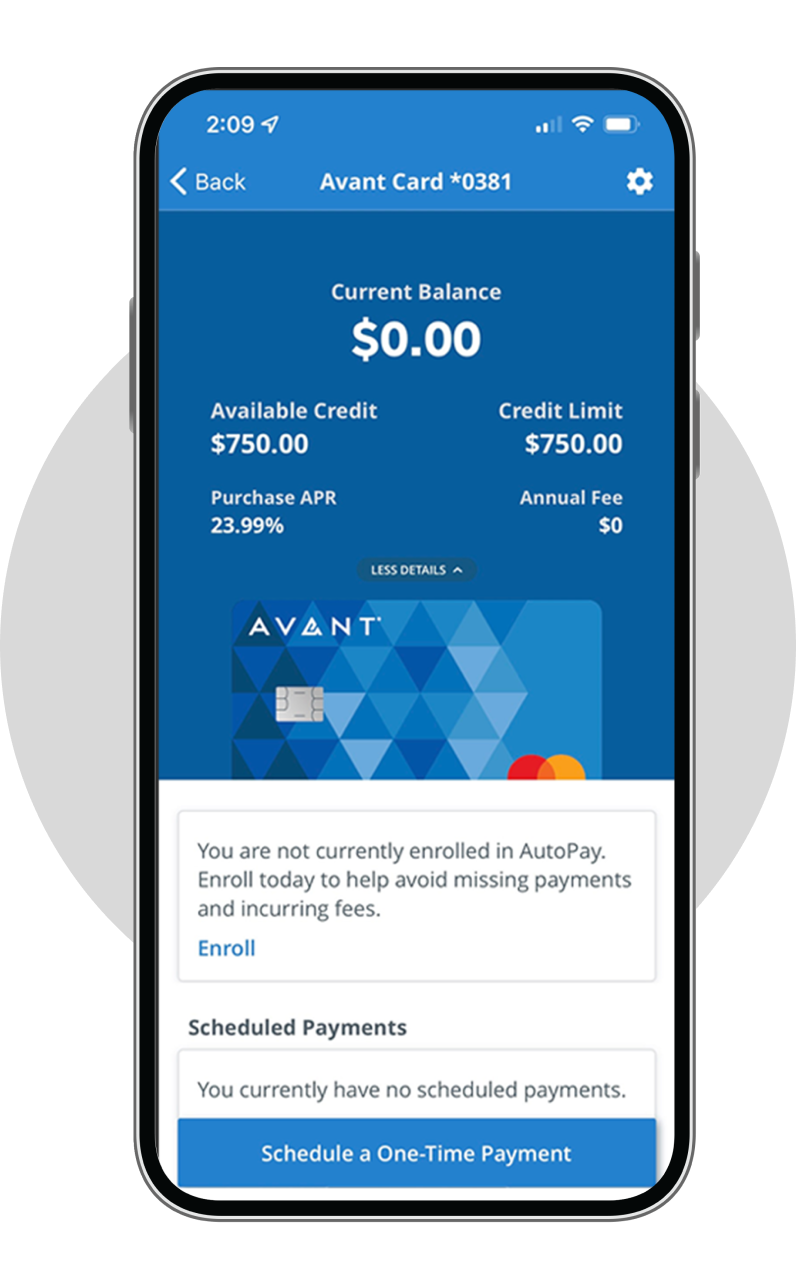

CREDIT CARDS

The buying power you want

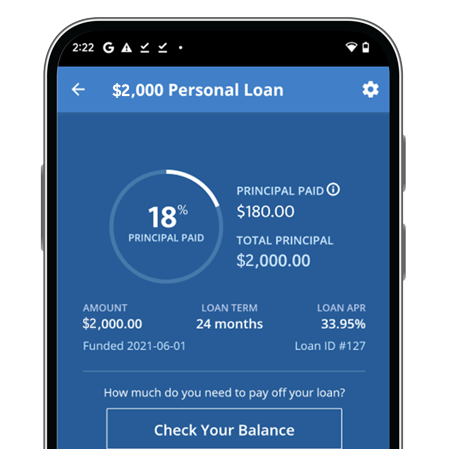

LOANS

Realize your personal goals

SUPPORT YOUR TEAM & EARN REWARDS MLS FORWARD CREDIT CARD

////////SAVE////BUILD////GO////ASPIRE////STRIVE////SAVE////BUILD////GO////SUCCEED////STRIVE////SAVE////BUILD////GO////ASPIRE////STRIVE////SAVE////BUILD////GO////ASPIRE////STRIVE////SAVE////BUILD////GO////SUCCEED////STRIVE////SAVE////SAVE////BUILD////GO////ASPIRE////STRIVE////SAVE////BUILD////GO////SUCCEED////STRIVE////SAVE////BUILD////GO////SUCCEED////STRIVE////SAVE////BUILD////GO////SUCCEED////STRIVE////SAVE////SAVE////BUILD////GO////ASPIRE////STRIVE////SAVE////BUILD////GO////SUCCEED////STRIVE////SAVE////BUILD////GO////SUCCEED////STRIVE////

WE'RE ON YOUR SIDE AND IN YOUR CORNER

We provide support to help you stay on track and keep moving forward toward success.

WE PROTECT YOUR PRIVACY

REAL HELP FROM REAL PEOPLE

COMMON QUESTIONS ANSWERED

WITH THE AVANT CREDIT APP

YOU'RE IN CONTROL

DOWNLOAD THE APP

LOOKING TO LEARN MORE? WE GOT YOU

THE LATEST FROM THE AVANT BLOG

Achieve Financial Stability With A Budget

LEARN ABOUT LIFE AT AVANT

Moving financial lives forward.

THE LATEST NEWS FROM AVANT

Major League Soccer and Avant announce multi-year partnership